CONTACT US

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

1021223-00006-00

Avraham "AY" Rappaport, CLTC

President, Financial Professional

Yaniv "Jay" Natanov

President, Financial Planner

Eli Rappaport

Vice President, Financial Planner

Shlomo Rosenstein

Financial Professional

Ozzie Marizan

Financial Planner

Joseph Greer

Employee Benefits Administrator

Dylan Pinsky

Client Relations Manager

Premier Financial

6395 Dobbin Road, Suite 102

Columbia, MD 21045

Phone: 240-309-6001

Email: dylan.pinsky@prudential.com

Website: premierfinancial1.com

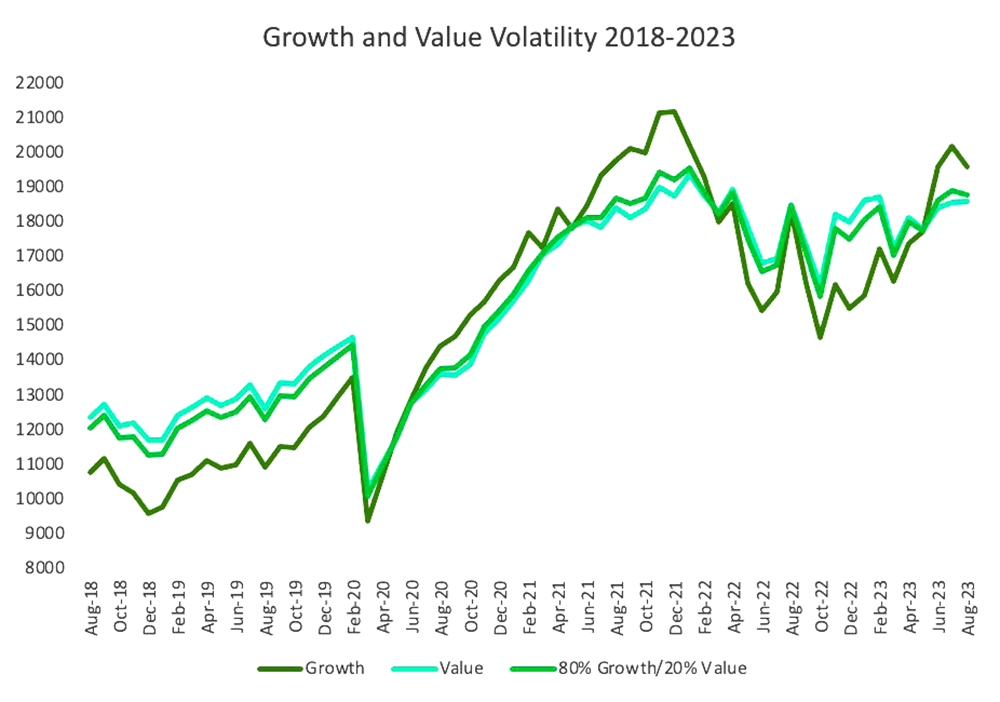

The 2022-23 inflation spike and accompanying stock volatility spurred many investors toward high-yield fixed-income investments as risk protection for their portfolios. But with core inflation edging lower and stock volatility more in hand, you may want to look at another investment—value stocks—to diversify* your portfolio further in 2024.

Value stocks are frequently linked to solid, well-established businesses that operate in dependable sectors. Although their development rates may be slower, they are seen as financially reliable and may be undervalued by the market. Growth stocks are often found in sectors with strong growth potential, such as emerging markets, healthcare, or technology. These businesses may have greater volatility because they are frequently in their early phases and reinvesting profits in growth.

What reduces the volatility and risk of value stocks? While their potential for capital appreciation may be moderate, they often offer steady income through dividends. In addition, the issuing company is already established and may have overcome many risks start-up or infant companies face. Meanwhile, growth stocks carry higher risk due to their higher volatility and market expectations.

While they offer the potential for significant capital appreciation, they may also experience greater price fluctuations and have a higher chance of underperforming during market downturns.

*Diversification cannot eliminate the risk of investment losses. Past performance won’t guarantee future results. Investing in stocks or mutual funds can result in a loss of principal.

Source: Wiltshire Growth and Value Total Market Indices, Economic Research Division of the Federal Reserve Bank of St. Louis and LTM Marketing. Note that you cannot invest directly in an index.

1074445-00001-00

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Premier Financial is not affiliated with Prudential Financial. Premier Financial sells insurance products of Prudential Financial's affiliated insurance companies in addition to products of non-affiliated insurance companies. Premier Financial is authorized to sell and service certain insurance products of Prudential Financial companies as well as use this material. Premier Financial and its representatives do not give tax or legal advice. Please consult with your own advisors regarding your particular situation. Offering financial planning and investment advisory services and programs through Pruco Securities, LLC (Pruco), under the marketing name Prudential Financial Planning Services (PFPS), pursuant to a separate client agreement. Offering insurance and securities products and services as a registered representative of Pruco, and an agent of issuing insurance companies. 1-800-778-2255. Dylan Pinsky is employed by Eli Rappaport and not The Prudential Insurance Company of America or its subsidiaries.

This newsletter is general educational information provided by a Prudential Financial Professional and is not intended to market or sell any specific products and services, but rather provide general information about the subject matter covered only.

Premier Financial and LTM Marketing Specialists LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Client Marketing, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.