CONTACT US

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

1021223-00006-00

Jeffery Palmer, ChFC®

Financial Planner

CA Insurance Lic. #0F60729

Cathy Davis

Client Service Specialist

Phone: 828-333-4748

Christina Palmer

Client Service Specialist

Phone: 828-333-4747

christina.palmer@prudential.com

Gaylen Allen

Client Service Specialist

Phone: 828-575-1250

Jaclyn Schmitz

Client Service Specialist

Phone: 828-333-4139

The Palmer Group

603 Alliance Court

Asheville, NC 28806

Phone: 828-687-8818

Fax: 828-687-4482

Website: jeffpalmergroup.com

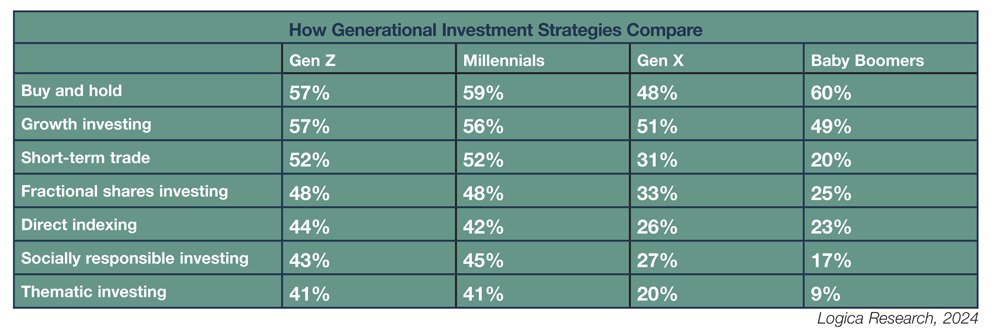

As the youngest generation to enter the financial markets, Generation Z (those born between 1997 and 2012) is making waves with their unique perspective on investing. Unlike their predecessors, Gen Z's approach to stocks is shaped by technology, social media, and a keen awareness of global issues. This generation's investment habits are redefining traditional stock market practices and contributing to the rise of new trends and sectors.

752234

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Jeffrey Palmer is a Financial Planner with, and offers securities and investment advisory services through LPL Enterprise (LPLE), a Registered Investment Advisor, Member FINRA/SIPC, and an affiliate of LPL Financial.

LPLE and LPL Financial are not affiliated with The Palmer Group.

This newsletter is general educational information provided by a Prudential Financial Professional and is not intended to market or sell any specific products and services, but rather provide general information about the subject matter covered only.

The Palmer Group and LTM Marketing Specialists LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Client Marketing, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.