CONTACT US

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Manny Gonzalez, II, AIF®

Investment Advisor Representative

Signature Financial Group, LLC

9150 South Hills Blvd, Suite 200

Broadview Heights, OH 44147

Phone: 216-642-9556 Ext. 320

Fax: 216-642-5508

Cell: 440-731-0321

Text: 440-583-6146

Email: mgonzalez@sfg4you.com

Website: MGONZALEZWEALTH.COM

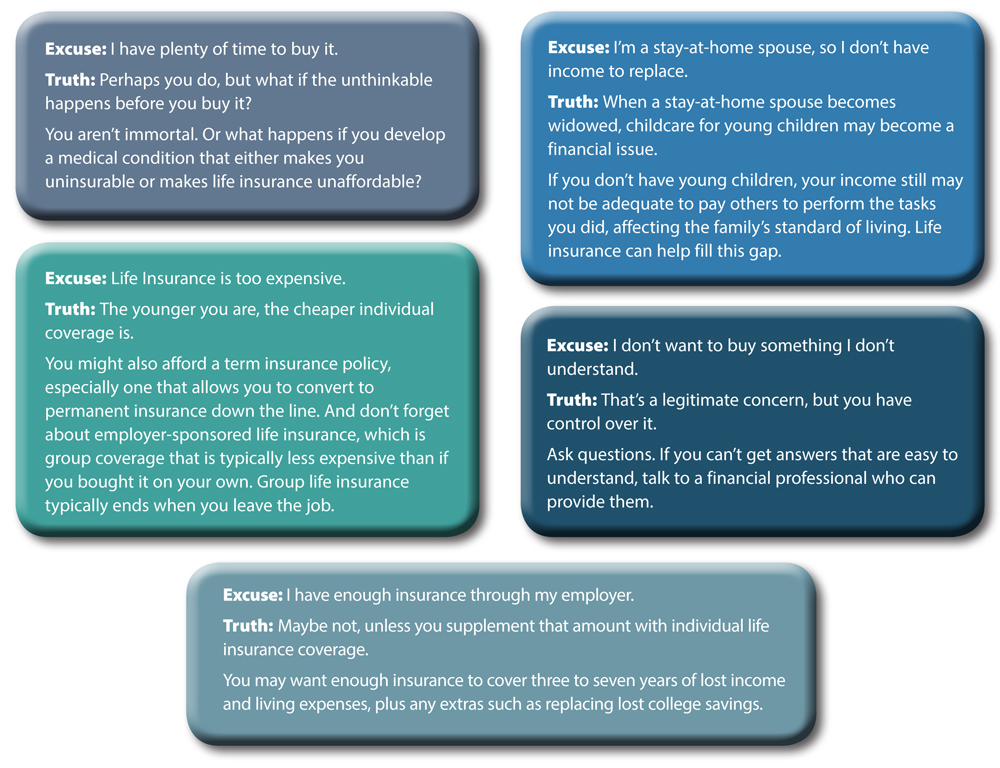

According to LIMRA, the pandemic raised awareness about the important role life insurance plays. However, some of us still have excuses to either not own life insurance or not own enough. Here's to setting the record straight:

Excuse: I have plenty of time to buy it.

Truth: Perhaps you do, but what if the unthinkable happens before you buy it? You aren't immortal. Or what happens if you develop a medical condition that either makes you uninsurable or makes life insurance unaffordable?

Excuse: Life Insurance is too expensive.

Truth: The younger you are, the cheaper individual coverage is. You might also afford a term insurance policy, especially one that allows you to convert to permanent insurance down the line. And don't forget about employer-sponsored life insurance, which is group coverage that is typically less expensive than if you bought it on your own. Group life insurance typically ends when you leave the job.

Excuse: I'm a stay-at-home spouse, so I don't have income to replace.

Truth: When a stay-at-home spouse becomes widowed, childcare for young children may become a financial issue. If you don't have young children, your income still may not be adequate to pay others to perform the tasks you did, affecting the family's standard of living. Life insurance can help fill this gap.

Excuse: I don't want to buy something I don't understand.

Truth: That's a legitimate concern, but you have control over it. Ask questions. If you can't get answers that are easy to understand, talk to a financial professional who can provide them.

Excuse: I have enough insurance through my employer.

Truth: Maybe not, unless you supplement that amount with individual life insurance coverage. You may want enough insurance to cover three to seven years of lost income and living expenses, plus any extras such as replacing lost college savings.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Securities and investment advisory services offered through Osaic Wealth, Inc. member FINRA/SIPC. Additional advisory services offered through Signature Equity Partners, LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth.

Signature Financial Group, LLC and LTM Marketing Solutions, LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Marketing Solutions, LLC, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.