SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

David P. McCabe,

WMCP®, ChFC®, CLU®

Financial Planner

Nathaniel D. High,

CFP®, RICP®

Financial Planner

nathaniel@centuriafinancial.com

Nicholas J. Over, CFP®

Financial Planner

nicholas@centuriafinancial.com

Sara E. Martin

Operations Manager

Molly R. Kelsh

Client Service Specialist

Centuria Financial Group

2333 Baltimore Blvd Suite B

Finksburg, MD 21048

Phone: 443-952-7232

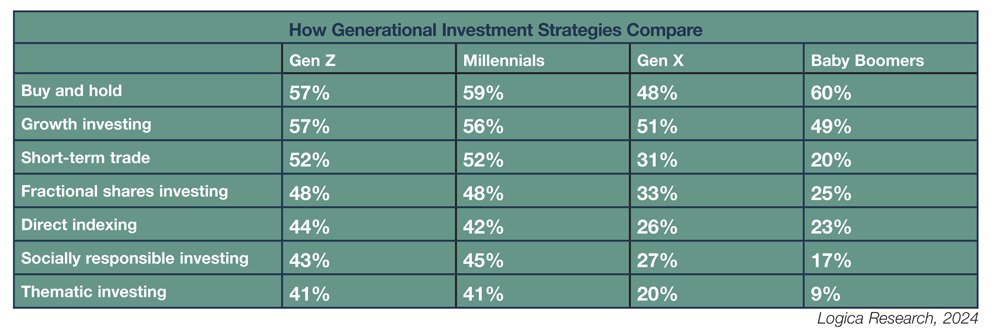

As the youngest generation to enter the financial markets, Generation Z (those born between 1997 and 2012) is making waves with their unique perspective on investing. Unlike their predecessors, Gen Z's approach to stocks is shaped by technology, social media, and a keen awareness of global issues. This generation's investment habits are redefining traditional stock market practices and contributing to the rise of new trends and sectors.

752234

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

David P. McCabe, Nathaniel D. High, and Nicholas J. Over are Financial Planners with, and offer securities and investment advisory service through LPL Enterprise (LPLE), a Registered Investment Advisor, Member FINRA/SIPC, and an affiliate of LPL Financial.

LPLE and LPL Financial are not affiliated with Centuria Financial Group.

This newsletter is general educational information provided by a Prudential Financial Professional and is not intended to market or sell any specific products and services, but rather provide general information about the subject matter covered only.

Centuria Financial Group and LTM Marketing Solutions, LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Marketing Solutions, LLC, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.