SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Breta Grumbois, CRPC®

Vice President, Wealth Management

Fibre Financial Group

Retirement and Investment Services

Located at Fibre Federal Credit Union

822 Commerce Avenue, Longview, WA 98632

Phone: 360-414-4223

Email: bgrumbois@fibrecu.com

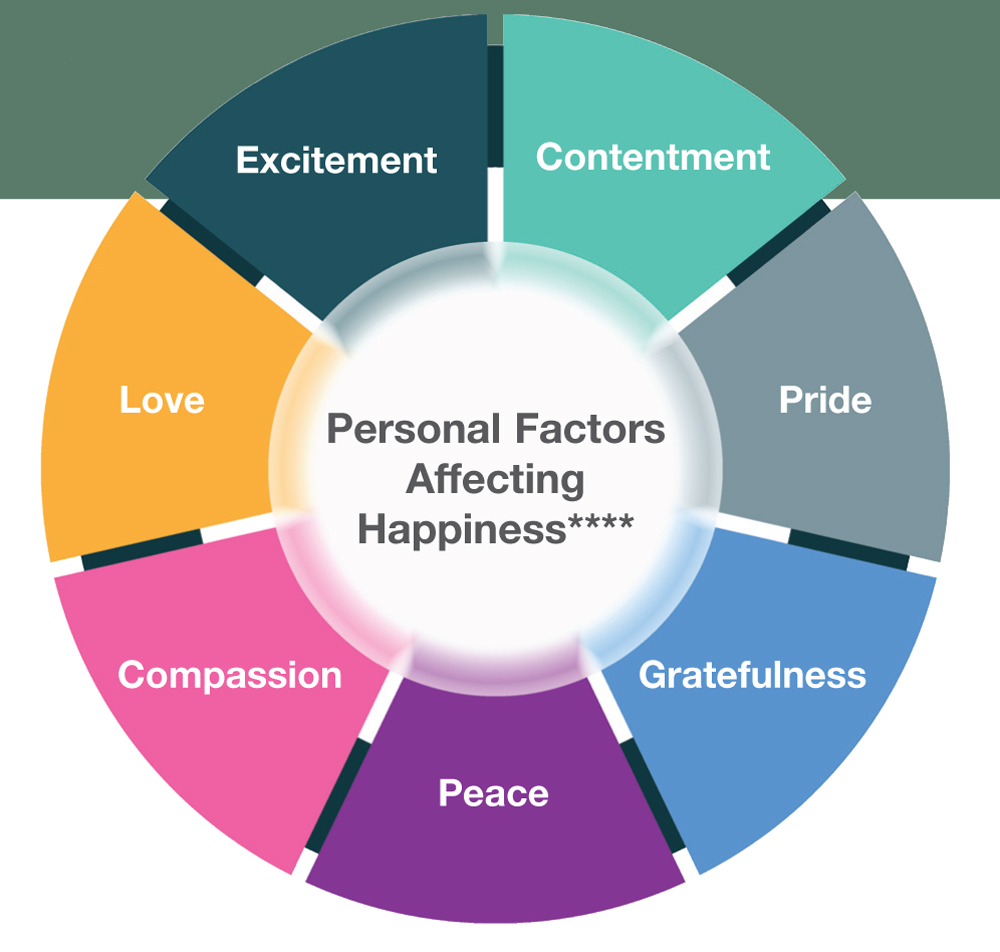

Everyone views wealth in a very personal way. Life experiences often influence those views. Many studies have been done on the subject, and here are some of the findings.

People at all income levels are tempted to use raises and bonuses to splurge. Before you treat yourself, financial professionals advise you to consider using raises and bonuses for any outstanding debt, to increase retirement savings, and for other investments. Then, treat yourself.

*Well Being Depends on Social Comparison, 2021

**Long-Run Effects of Lottery Wealth on Psychological Well-Being, 2020

***American Psychological Association, cited by Psychology Today, 2024

****American Psychological Association, cited by Psychology Today, 2024

594801

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Fibre Federal Credit Union and Fibre Financial Group Retirement and Investment Services are not registered as a broker/dealer or investment advisor. Registered representatives of LPL offer products and services using Fibre Financial Group Retirement and Investment Services, and may also be employees of Fibre Federal Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from and not affiliates of Fibre Federal Credit Union or Fibre Financial Group Retirement and Investment Services. Securities and insurance offered through LPL or its affiliates are:

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.